I’m not about to teach Granny how to suck eggs; you know how important invoicing is to your business. After all, if you don’t invoice your clients, you don’t get paid. And if you don’t get paid, your legal business won’t last very long, will it?

In the second part of our processes series, I’ll talk you through the exact thought process and steps I’ve taken to map out one of our new client’s invoicing Standard Operating Procedures (SOPs).

We’ve already covered why documented processes are so important in part one, but let’s make sure we’re clear on why your invoicing process is so important before giving you the tools you need to create a solid set of standards for your business.

Why is a documented invoicing SOP so important for my legal business?

Invoicing is perhaps THE most repeated task in a law firm, and it’s one of the most delegable. Yet, time and time again, we see valuable – and billable – lawyer hours spent on this tedious task. A documented task that leaves no room for misinterpretation means a task that can be delegated with ease.

With the right procedures, your clients know what to expect from you, and what you expect of them with regards to payment terms and billing. Your team will be able to answer billing queries from clients, and will know from your documented SOPs who they should seek advice from if they don’t know the answer to a billing query.

How to put together invoicing Standard Operating Procedures for law firms

So how can you map out your own invoicing process for your legal business?

Our team produces SOPs for law firms of all sizes and we recently took on a start-up law firm as a new and lovely client. Here are the exact questions we put to them and the process we followed to get their processes right from the start:

- Who is doing what at each stage of the process? Is this the Fee Earner, a PA, or a Finance team? It’s useful to think about timescales at this stage too; how quickly should invoices be raised?

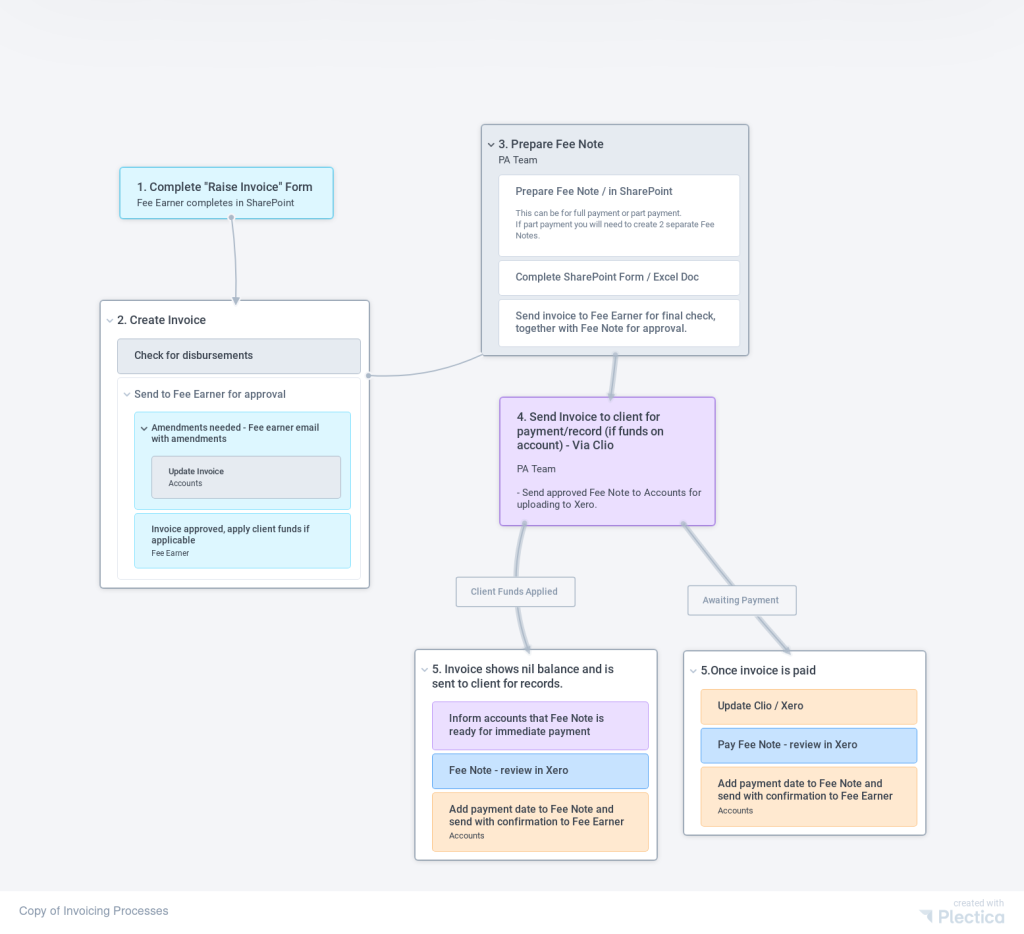

- We then started mapping out a process in Plectica – software for creating visual diagrams like the example below. The Plectica diagram was incorporated into a detailed SOP document which details the person responsible for each task.

- At this point, I added links into the SOPs for Loom (video) and Scribe (screenshots) which include step by step instructions for:

a) “How to create an invoice in Clio”

b) “How to create a Client Funds Request in Clio”

c) “How to create Fee Notes”

- We then considered how the request should be actioned by the lawyer, resulting in us putting together an online form that falls into a centralised PA inbox.

- We considered the frequency of billing and this varied depending on the task – you could bill on an adhoc basis, weekly, fortnightly, monthly, or at precise stages throughout a process.

- If an invoice becomes overdue, how should the business respond, who will deal with this, and how frequently? Unfortunately, it’s a necessity to consider this in your procedures.

- We gave our new client the pros and cons of using email to send invoices, and the benefits of using a CRM to carry out this task. It’s important to think about how your time will have been tracked and therefore if you’ll need to download your time reports to send as an attachment with invoices, or if the time is included with your bill automatically.

- We put together email templates for our client, so that they could set the tone they wanted in each email and save the team valuable time.

- We made sure relevant codes were set up for disbursements and other items, which is crucial if you’re integrating your accounting software with your CRM.

- Once complete, we used all the responses, diagrams, videos and screenshots to put together a robust, tidy document that’s easy for the team to follow.

How do I put together a simple SOP for my legal business?

Using Word or Google docs for a simple process outline is great for small and growing teams. As an example, here’s how we’d put together a simple bullet-point Word document for a Client Funds Request:

- The lawyer will agree monies to be collected with the client and put in a client fund request

- The PA will receive that request and create the funds request to send onto the lawyer for approval

- The lawyer approves the request and sends it to the client

- The finance team have access to the bank account and can notify the lawyer or PA when a payment is received

- The lawyer can now start work

We hope this post has given you a useful insight into our thought process when creating SOPs for legal businesses.

Did we mention that our team are experts at putting together essential processes such as invoicing? Ensure your cash flow’s protected and your team have the know-how to invoice clients promptly by asking Kellie Simpson Legal to get your processes in order. To find out more about how we can keep your business moving, get in touch now.

And don’t forget to look out for the next blog in our processes series, coming to you very soon!